What if your tax bill was 0% – legally!

You didn’t have to go to the Cayman Islands, no Swiss bank accounts…

If this sounds too good to be true… then maybe its time to brush up on Australian Tax entities.

There are FOUR key Tax entities you should know about, and when to use them!

INDIVIDUALS | COMPANY | SUPERANNUATION | (‘THE SECRET 0% TAX ZONE’)

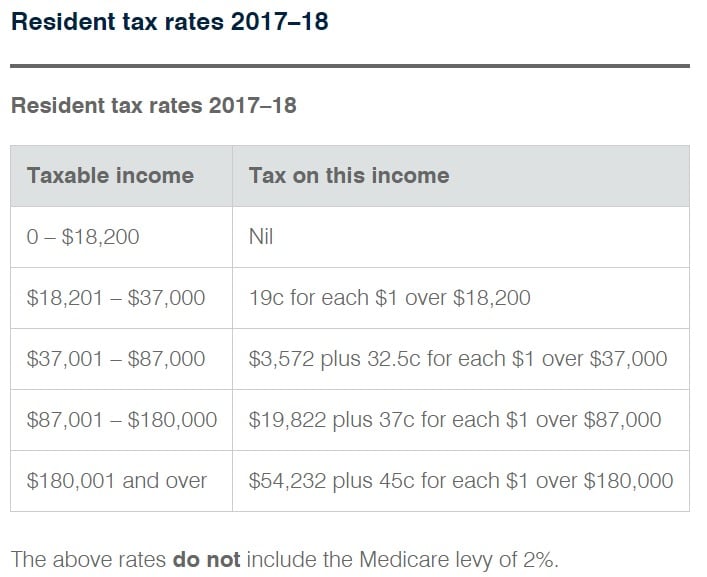

INDIVIDUALS (0%-45%*)

An individual is someone that is ‘employed’ – and your employer withholds your tax.

It’s called a ‘marginal tax rate’ – the more you make the more they tax you:

HOT TIP #1 – don’t be fooled. Let’s say you earn $100k and you are in the 37c in the dollar category – that DOESN’T mean you pay 37%, (Its closer to 26% due to the brackets leading up to $100k).

HOT TIP #2 – use http://www.paycalculator.com.au to work out what you should be paying in tax, medicare levies, super etc.

HOT TIP # 3 – Thinking about saving on tax, check out these great apps that can help https://whatifadvice.com.au/top-5-money-apps-what-if-you-could-say-goodbye-to-spreadsheets/

https://www.ato.gov.au/Rates/Individual-income-tax-rates/

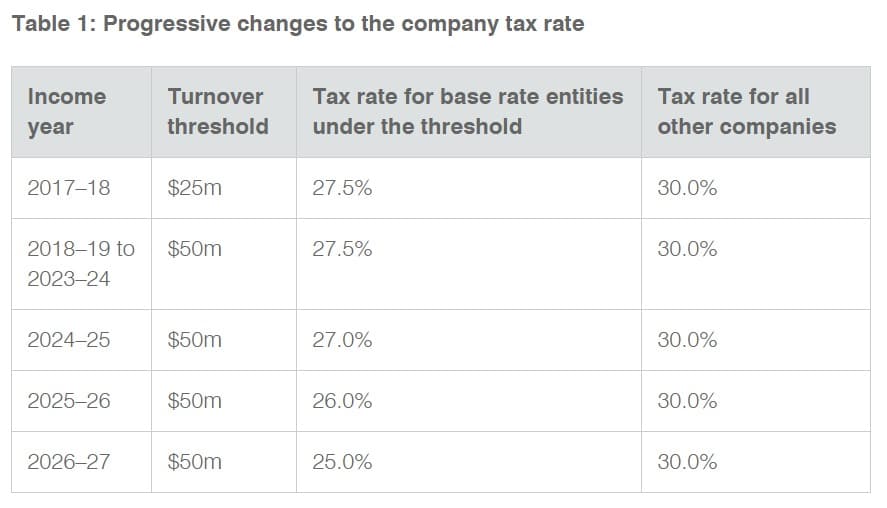

COMPANIES: (27.5%*)

Company tax rates have recently changed, and for small businesses have changed to 27.5%

If all goes to plan, this rate will continue to drop.

https://www.ato.gov.au/Rates/Changes-to-company-tax-rates/#Baserateentitycompanytaxrate

SUPERANNUATION…. In accumulation phase (15%*)

Superannuation Tax is a little tricky, and it depends on a large range of factors – so please use this as a guide only.

There are two key elements, tax on money going INTO super, and tax on money coming OUT of super.

Going in, the tax rate is 15% (if its from an untaxed source, like from your employer)

Super really is quite complicated – you’ll have to check out our other blog posts for more specific super information, or of course give us a call.

https://www.ato.gov.au/individuals/super/super-and-tax/tax-on-contributions/

THE SECRET 0% TAX ZONE!!! – yep… 0%!

This is a real place, and so many Australians aren’t aware it exists or how it works.

It is actually:

SUPERANNUATION … In Pension phase (retirement phase, income phase, the part of super where you get to take money out)…

Capital Gains, Income, Yields, Dividends – its all taxed at 0%!

Think of it like this, if ‘Super in accumulation phase‘ is the ‘in bucket‘ of your super, then ‘Super in pension phase‘ is the ‘out bucket’.

Note – to use this part of your super, one of the major elements is, you must have met a ‘condition of release’ –

Now I hear you, “I’m still years away from retiring so how does that help me?”

Well…

Step 1. Just be aware that its there!

Step 2. Come up with a strategy to maximise the amount of money you have in this 0% zone; without affecting your other ideas/goals. (ie, a 25 year old saving for a house may not decide to shovel money into super as its counter productive, however if you’re 45+ and you haven’t considered Super – you’re doing yourself a disservice!

Don’t have a strategy? You know where to find us!

Example:

Picture this.

Person 1, has managed to save and invest wisely over their career – and can now retire on a passive income of $150k – nice work!

Person 2, has done the same.

HOWEVER Person 1, has all of their investments in their personal name, and thus they pay tax as an INDIVIDUAL, and will pay $46k of that $150k to the tax man!

Whereas Person 2 spent the 10 years leading up to retirement transferring their assets into super… and thus pays 0%!

Person 1 retires age 65, and lives until they are 85 – that’s $920k in tax over 20 years that they will need to pay….

Let me say that again…

Nine Hundred and Twenty Thousand Dollars! – ($920,000!)

Please don’t make me say it……. PLEASE DON’T MAKE ME SAY IT…. *cough* COMPARE THE PAIR!